Write to us

About Factoring

Factoring České spořitelny, a.s. is a modern financial company focused on factoring operations. We provide our clients with receivable funding, management, security and collection.

- We are a member of Financial group of Ceska sporitelna Bank, which holds a 100% share in our company.

- We are also a member of the biggest factoring organization network in the world Factors Chain International (FCI), which has more than 150 members in 50 countries of the world.

- We are a founding member of Association of factoring companies in the Czech Republic.

Our advantages:

- We provide funding for production, service and business companies.

- We have a system which allows us to provide factoring services complying with international standards.

- Our service range is comparable to services provided by international factoring industry leaders.

- Individual approach to client.

- Possibility to take advantage of more ways of factoring cooperation if you have many customers.

- Our service range is extensive as we are part of a strong Financial group of Ceska sporitelna Bank.

- Our sales representatives are region specific.

- Short pre-cooperation validation period and flexibility in response to requirements of our current clients.

Who are our services for ?

The main reasons to take advantage of factoring services are lack of cash for further company expansion, call for efficient cashflow planning or receivable securing.

Our services are used by:

- small and medium businesses with yearly turnover higher than 30 million CZK, providing goods or services to domestic or foreign customers on a regular basis and having invoices with due dates between 14 - 90 days,

- bigger companies that do not want to take out more loans (factoring has no impact on liability accounts of balance sheet) or want to outsource receivable management, which helps them to improve customer payment discipline, decrease administrative costs and consequently decrease fixed costs.

In general our services can be a solution for clients:

- having, due to expansion, higher financial needs than their loan limit approved by bank

- not having met all bank validation criteria but having an interesting customer portfolio

- being in need of additional funds but not wanting to take out more bank loans

- wanting to decrease costs and outsource receivable management

Management and collection of receivables

Our factoring company ensures receivable management and collection, including all administrative work, which will allow you to focus on your production or business activities. Thanks to our sophisticated receivable and collection management systems, as well as an automatic reminder sending system, you can expect a faster and better collection of your receivables. We also provide you with detailed statistical information and actual or period overviews.

Product advantages:

- You can fully focus on your business - Factoring České spořitelny takes care of all your receivables from origin to collection

- Automatic reminder sending system to customers with overdue payments.

- No more language and time limits when communicating with foreign customers.

- Up-to-date overview of payment discipline of your customers thanks to on-line connection to secured internet pages - eFactoring

- Factoring České spořitelny is an impartial party with banking background

- Decrease of personal and administrative costs for dynamically expanding companies

Domestic factoring

Domestic factoring is a complex cash flow improvement financial service. Cash flow can seriously be affected by deferred payment sales to foreign customers. This service comprises management, funding, securing and collection of domestic customer receivables.

We ensure:

- smooth payment of your domestic receivables (invoices) within approved limit

- advance payment of up to 90% of nominal invoice value within 48 hours, if you have a bank account with Ceska sporitelna Bank your money are available immediately

- in case of regression free factoring - overdue or non-payment risk take over

- invoice collection and management as well as detailed statistical information

- eFactoring – Internet application providing you with on-line access to up-to-date information

Reverse factoring

Are you looking for ways to finance and better manage your supplier-customer chains?

Take advantage of your strong position in customer-supplier relations!

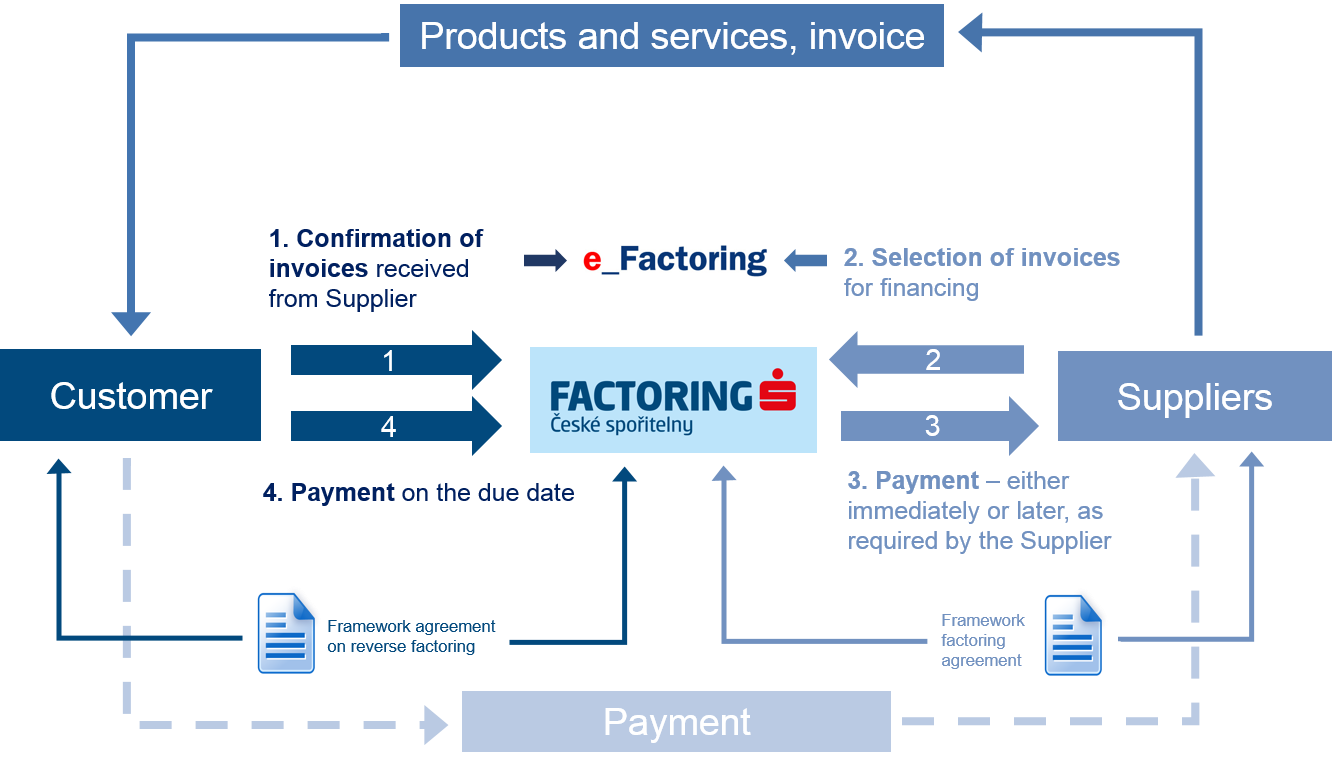

Use a solution for the financing of your suppliers that is based on a confirmation of your commitments! All this may be done electronically via the eFactoring Internet platform, with the support of EDI, electronic document interchange that has been made possible due to our partnership with EDITEL, a leading international provider of electronic document interchange services.

What is reverse factoring?

- A simply controlled, fully automatic tool for up to 100% financing of your suppliers on the basis of a confirmation of your business commitments

- Your working capital is optimised thanks to an extension of the due dates of your suppliers’ invoices

- Obtain extra sources of financing without increasing your credit engagement

Reverse factoring is a method used in the financing of customer-supplier relations (Supply Chain Finance) that supports business cooperation between companies of varying sizes and financial strength. Whereas in standard factoring, the client is the supplier who assigns his receivables from multiple customers and obtains immediate payment on its invoices, in the case of reverse factoring, the client is one large solvent customer who has a larger number of smaller suppliers.

What will reverse factoring bring you?

- Better utilisation of your working capital thanks to an extension of the due dates of your suppliers’ invoices

- The possibility to ask your suppliers to extend their due dates without an adverse impact on their financial situation

- Securing extra sources of financing without increasing your credit engagement with banks

- The possibility of using reverse factoring in negotiating more favourable prices from your suppliers

- No minimum or maximum limit on the amount of supplier invoices for financing

- Stabilisation of your supplier portfolio

A win-win solution

Together, we will select and approach your suppliers with an offer of factoring financing for up to 100% of their receivables from your company, without an adverse impact on their financial situation – subject to pricing conditions based on your company’s creditworthiness. On this occasion, you can request an extension of the due dates of their invoices or other conditions governing your business relations. This will allow you to yet better optimise your cash flows and to move working capital from short-term assets to the development of your company. And with reverse factoring, your suppliers can secure a more stable position within your supplier portfolio.

How does reverse factoring work?

Take advantage of reverse factoring, a modern method for the financing of the customer-supplier chain (Supply Chain Finance) and cooperate with Factoring České spořitelny, a major player on the Czech factoring market.

Please contact us to request a customised offer.