ediFactoring

Are you looking for ways to better finance and manage your supplier-customer chain?

Use ediFactoring, electronic document interchange, with your factoring financing!

Have your receivables financed, managed, and insured through traditional domestic or export factoring or use financing of your suppliers by means of reverse factoring on the basis of a confirmation of your commitments! All that can be done electronically via the eFactoring Internet platform, with the support of EDI, electronic document interchange made available thanks to our partnership with EDITEL, a leading international provider of electronic document interchange services.

The modern digital ediFactoring service offers an ideal solution for automated and efficient financing of your supplier-customer relations (Supply Chain Financing) because:

- with electronic data interchange between the supplier, Factoring České spořitelny, and the customer, work with documents (in particular, invoices and delivery documents) is automated and financing for your company or your suppliers is faster,

- you can use support in the form of EDI communication for traditional as well as reverse factoring,

- the strategic partner of Factoring České spořitelny for the use of EDI is EDITEL.

Accelerating your financing

If you are using an EDI solution from EDITEL for electronic document interchange between you and your customers or suppliers, do not hesitate to approach us with a request for an offer of factoring financing. Electronic data interchange between you and us will help reduce your administrative burdens and accelerate the provision of financing to your company.

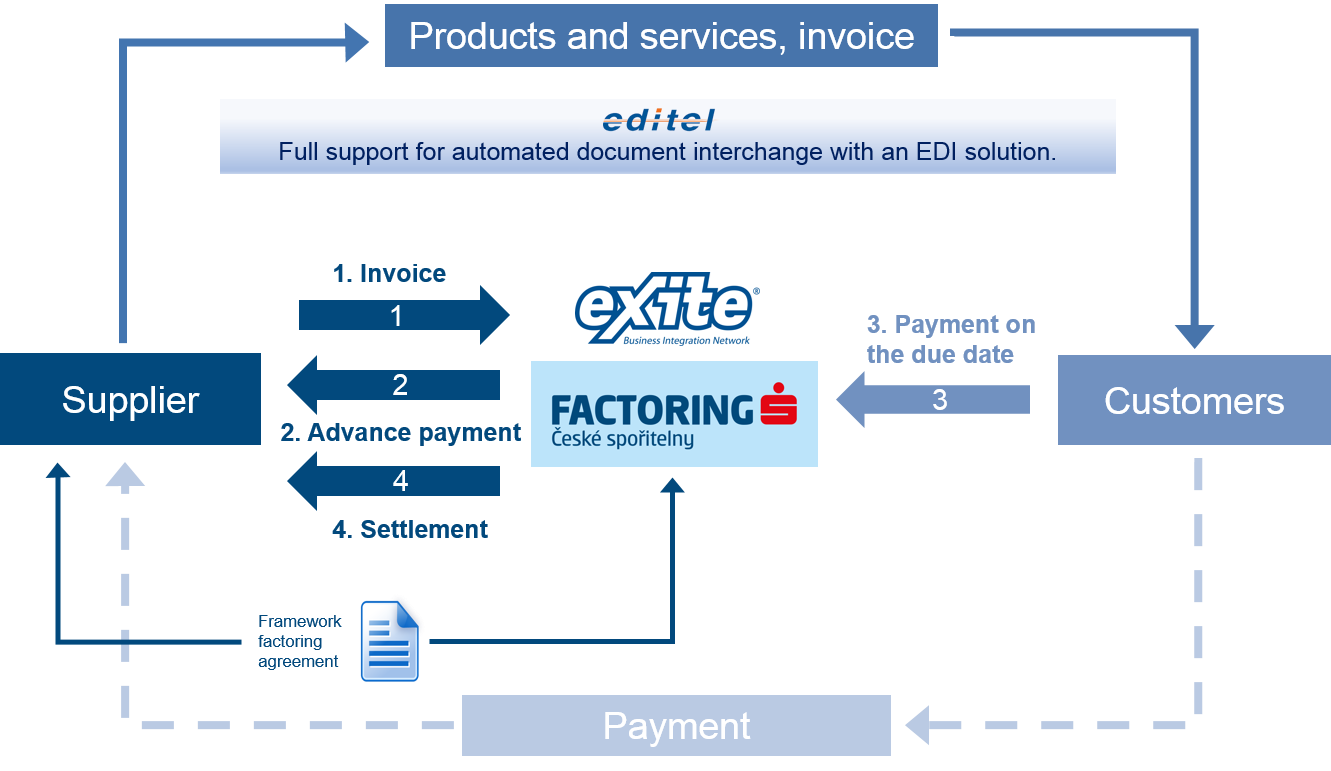

How does traditional ediFactoring work?

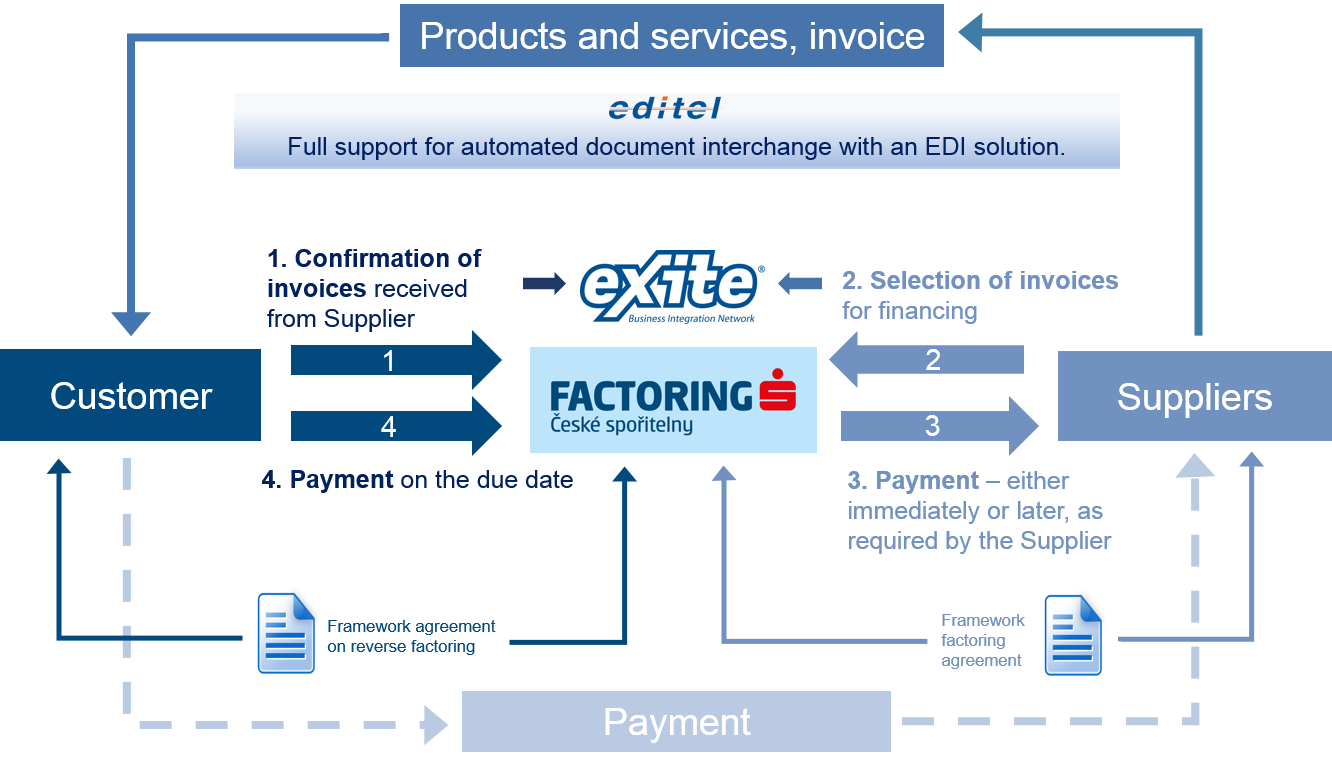

How does reverse ediFactoring work?

Take advantage of factoring-based financing and combine it with the advantages of electronic document interchange (EDI). Cooperate with Factoring České spořitelny, a major player on the Czech factoring market.

Please contact us to request a customised offer.

Export factoring

Export factoring is a complex cash flow improvement financial service. Cash flow can seriously be affected by deferred payment sales to foreign customers.

Our export factoring services comprise the following:

- protection against bankruptcy or low payment discipline of your customers (up to 100% coverage of your receivables)

- smooth settlement of your invoices (receivables) issued to approved customers

- advance payments of up to 90% of invoiced amount

- payments in CZK or convertible currencies to your CZK or foreign currency bank accounts, based on your choice

- management and collection of your receivables

- eFactoring – Internet application providing you with on-line access to up-to-date information

Import factoring

Import factoring is a special financial service, which allows you to purchase goods from your foreign suppliers without credit notice opening, bank guarantee or bill of exchange aval.

If you use import factoring you order your goods as normally but when your supplier's invoice becomes due you pay directly to our account, instead of paying your supplier.

Option - Direct supplier funding

eFactoring

eFactoring is a modern complement to factoring services. This internet-based solution provides you with on-line overview of your advance payments and receivables, as well as other information regarding factoring. You can better plan your business activities and cash flow thanks to the following:

- on-line detailed overview of your receivables and advance payment usage ratio per customer 24 hours a day

- easy and secured connection to overviews on available resources

- monitoring of payment discipline of your customers

- up-to-date overview of all business contracts and their terms

- searching for individual advice notices or their lists based on selected time period

- statistics of your factoring turnover total and period based number of assigned invoices

Early warning system

Early warning system is service for clients which want monitor changes on the side of their Czech customers (e.g. bankruptcy, insolvency, liquidation, debts, changes in Trade register).

Factoring system sends an information immediately to selected client email adresses in case of change detection.